April 27th, 2023

What to Look for When Selecting a FinTech Software Company?

Table of contents

Welcome to the world of FinTech, where innovation meets disruption.

You probably know firsthand the fast-paced nature of this industry, where staying ahead of the curve is essential to succeed.

According to KPMG, global FinTech investment reached a record high of $105 billion in 2020, with software development being a crucial component of FinTech innovation and growth. Moreover, the global FinTech software market size is expected to reach $305 billion by 2026.

In this dynamic landscape, one key ingredient to unlocking excellence is partnering with the right software development company.

From “blockchain” to “AI-powered” and “cloud-native” to “disruptive,” the FinTech industry is rife with trendy catchphrases that can dazzle and confuse in equal measure. As CEOs and CTOs of enterprise companies, you know better than anyone that it won’t drive your business forward.

This article will delve into what truly matters when selecting a FinTech software development company.

Namely, we’ll explore:

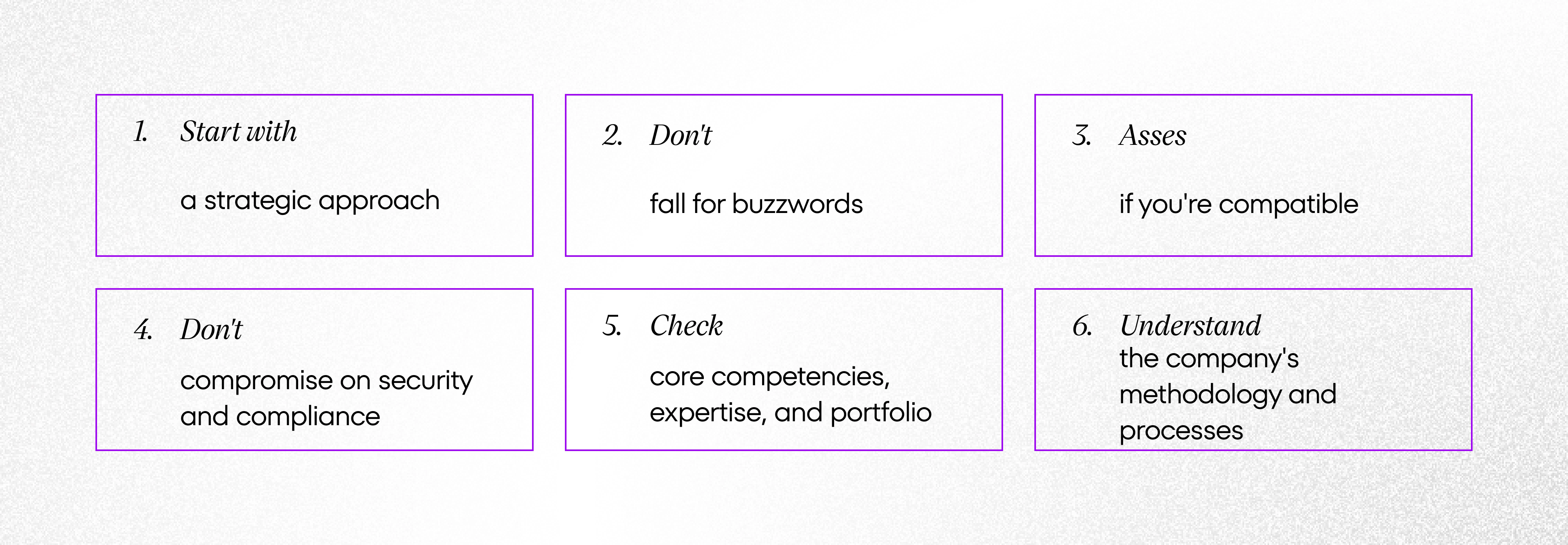

- Why is the need for a strategic approach a crucial first step?

- How to assess the core competencies and expertise of the potential tech partner that will be valuable for your project? What technical skills are the most relevant in the FinTech industry, and what to look for in the company’s portfolio?

- How to know if the company takes security and compliance seriously?

- What’s important in terms of methodology, processes, communication, and collaboration?

Get ready to embark on a journey of informed decision-making that will shape the future of your financial venture.

What to Look for When Selecting a FinTech Software Development Company?

The Need for a Strategic Approach

When it comes to selecting a FinTech software services company, strategic thinking is not just a luxury, but a necessity.

You have to approach this decision with a clear strategic mindset that takes into account the long-term implications.

Strategic thinking involves looking beyond the surface-level promises and evaluating the true capabilities of a FinTech software development company.

It means asking the tough questions, conducting thorough due diligence, and scrutinizing the track record of potential partners. It’s about considering factors such as technical expertise, domain knowledge, and relevant experience in the FinTech industry.

A strategic approach also involves aligning the selection process with your overall business goals and vision.

- What are your specific needs and requirements?

- How does the potential FinTech consulting firm fit into your broader strategy?

It’s essential to look at the bigger picture and make decisions that align with your long-term objectives.

Moreover, strategic thinking requires forward thinking. It’s not just about solving immediate challenges, but also anticipating future needs and trends.

Want to know more about the strategic approach to resolving the most common challenges of financial institutions? Download our free e-book on the digital transformation journey in finance.

Embrace the digital transformation in finance

Download e-bookFinTech and Its Many Forms

Within the broader FinTech space, there are several subcategories, each with its unique features.

When choosing a software development partner for your project, consider the expertise in the subcategory of FinTech relevant to you.

- Wealth tech focuses on helping individuals manage their wealth and investments. This includes tools for portfolio management, financial planning, and automated investment advisory services. Wealth tech platforms often use algorithms and ML to provide personalized investment recommendations and optimize investment portfolios for maximum returns.

- Regtech, or regulatory technology, is a subcategory of fintech that focuses on helping companies comply with complex financial regulations. Regtech platforms use ML and other technologies to help businesses automate compliance processes, monitor risks, and manage regulatory changes.

- Crypto is another subcategory of FinTech that has gained popularity in recent years. Cryptocurrency platforms enable users to buy, sell, and trade digital assets. These platforms use blockchain technology to provide a secure, decentralized system for conducting transactions without the need for intermediaries like banks or governments.

- DeFi, or decentralized finance, is a subset of crypto that focuses on creating decentralized financial applications operating on a blockchain network. DeFi platforms enable users to access financial services like lending, borrowing, and trading without the need for traditional financial intermediaries.

- Web3 is focused on creating a more decentralized, open internet. These technologies use blockchain and other decentralized systems to create more secure, transparent, and democratic online platforms. Web3 is still in its early stages of development but has the potential to transform the way we interact with digital content and conduct online transactions.

Read more: Web 3.0 and AI Will Not Yet Determine the Power of FinTech

Remember that different “FinTechs” require different technical skills, and choosing a partner who specializes in the area you’re working in can be critical to the project’s success.

Don’t Fall for Buzzwords of a FinTech Software Company

One of the biggest risks in the process of selecting a technology partner is falling for buzzwords without proper evaluation.

It’s essential to assess how the company’s offering aligns with your unique needs, technical requirements, and long-term vision.

For example, web3 will not work in every case, and sometimes it will be necessary to take a step back and address the basics first. Relying solely on trends usually results in wasted time, effort, and resources, as well as potential setbacks for your FinTech venture.

Rather, look for tangible evidence of the organization’s capabilities and expertise. Let us shed light on how we work at CSHARK.

We specialize in creating customized solutions for FinTech companies. Our team has extensive experience working with startups and established enterprises from the financial industry. We have a deep understanding of the challenges and opportunities faced by companies at different stages of their development.

We know that enterprises or international banks require a different approach to project execution than start-ups or founders.

Our FinTech software development services include custom software solutions (financial platforms, mobile apps, technology-based solutions, etc.), compliance & security, and innovation/scalability solutions for start-ups.

Security and Compliance in a FinTech Software Company

In the world of FinTech, security and compliance are not just buzzwords, but critical pillars that underpin the entire industry.

With sensitive financial data, transactions, and regulatory requirements at play, the stakes are high, and there’s a great need for robust security measures and compliance adherence.

Read more: What’s the True Price of Non-Compliance?

You need to prioritize security and compliance when selecting a FinTech software development company. A reputable partner should demonstrate a thorough understanding of the regulatory landscape and have a proven track record of compliance in their previous projects.

They should have their compliance game on point, with encryption protocols, access controls, regular security audits, and other security measures in place to protect your sensitive financial data.

Compliance with industry regulations and standards, such as GDPR, PCI-DSS, and other relevant laws should be non-negotiable. The FinTech consulting company should demonstrate a clear understanding of these regulations and have a proven track record of compliance in their previous projects.

Don’t Compromise

When it comes to security and compliance, there’s no room for compromise. Your solution is only as strong as its compliance foundation.

It’s like building a majestic castle on quicksand – it’s bound to crumble sooner or later.

A breach in security or non-compliance with regulations can have severe consequences, including financial losses, legal repercussions, and reputational damage.

You have to protect your customers, your business, and your reputation.

Be vigilant and ensure that the FinTech software company you choose takes security and compliance as seriously as you do.

Core Competencies and Expertise

The success of your FinTech project heavily relies on the capabilities and expertise of the software development company behind it.

It’s not just about what they claim to offer, but also about what they can truly deliver.

Evaluating the core competencies and expertise of a FinTech software company requires thorough research, probing questions, and evidence-based assessment.

When assessing the core competencies of a software development company, it’s essential to look beyond surface-level claims and delve into their technical capabilities.

- What technologies do they specialize in?

- What is their level of expertise in those technologies?

- Do they have a proven track record of successfully delivering complex FinTech projects?

Read more: Our Approach to FinTech Software and Product Development

Expertise in the FinTech domain is crucial. This is a highly regulated industry with unique challenges and requirements. A software development company that understands the intricacies of the FinTech landscape, including compliance, security, and data privacy, can provide invaluable insights and solutions.

Look for evidence of their domain knowledge, such as their experience in working with financial institutions, understanding of industry regulations, and familiarity with FinTech best practices.

Furthermore, a software development company’s expertise goes beyond technical skills.

It also includes their ability to understand your specific business requirements, communicate effectively, and work collaboratively with your team. Choose a company that can provide not only code but also valuable insights and strategic guidance to help you achieve your goals.

Technical Skills in a FinTech Software Company

FinTech Programming Languages

First and foremost, proficiency in programming languages that are commonly used in FinTech, such as Python, Java/JavaScript, C++, and .NET, is necessary. These languages are commonly used in developing financial applications, data analysis, and building robust and scalable systems.

At CSHARK, .NET is our core technology. In FinTech, .NET is used for several purposes:

- developing a wide range of financial applications, including trading platforms, risk management systems, and asset management systems; the framework offers a rich set of libraries, tools, and components that help to build robust and scalable apps,

- developing various financial services, such as financial analytics and reporting, risk assessment, and fraud detection; it provides advanced features for data analysis and visualization,

- integrating with financial systems, such as banking platforms and payment gateways; it can be used to build API clients that can interact with these systems,

- building blockchain applications, such as decentralized exchanges and smart contracts, using the .NET-based blockchain platforms (e.g. Stratis).

Read more: .NET Custom Application Development Our Way

Web3 and DeFi Programming Languages

Secondly, apart from the programming languages listed above, there are several ones used specifically in web3, and DeFi (Decentralized Finance) development. Some of the most common ones include:

- Solidity – a programming language designed for smart contracts on the Ethereum blockchain, which is widely used in DeFi development,

- Vyper – similar to Solidity, designed for smart contract development on the Ethereum blockchain,

- Rust – a systems programming language that is gaining popularity in the blockchain space due to its high-performance capabilities and security features,

- Go – used in developing various blockchain projects, including DeFi protocols, developed by Google and known for its concurrency and efficiency.

Financial Data Processing & Analysis

FinTech software development requires a deep understanding of financial concepts, data modeling, and analytics. Find a software development partner that has experience in working with financial data, such as processing transactions, handling complex calculations, and implementing algorithms for risk assessment and fraud detection.

Integration Capabilities

Financial systems often need to interact with various third-party APIs, payment gateways, and other financial platforms. Therefore, a software development company should have experience in integrating with different financial systems and platforms seamlessly.

Developing Mobile and Web Apps

With the increasing demand for mobile banking, digital wallets, and online payment solutions, a software development company should have the necessary skills to develop user-friendly, responsive, and secure mobile and web applications that cater to the needs of modern FinTech consumers.

Read more: What are 6 Main Benefits of Financial Applications?

Security

The FinTech industry is highly regulated, and data security is of utmost importance. A software development company must have expertise in implementing robust security measures, such as encryption, authentication, and authorization, to ensure that sensitive financial data is protected from unauthorized access.

Look for developers fluent in .NET, as it offers robust security features that are essential for FinTech applications (e.g. secure data storage). The framework has been designed with security in mind and provides tools and libraries to help developers build secure applications.

FinTech Portfolio is a Must-Have

It’s essential to thoroughly assess a company’s past performance and expertise in the FinTech domain to ensure they have the necessary experience to deliver exceptional results.

You can find software development companies’ portfolios, e.g. on Clutch.

Deep domain knowledge and technical expertise, compared with communication skills and project management, convinced us. (…) Due to a large number of projects, it’s safe to say that CSHARK has played and will play significant role in working with Fenergo. CSHARK supports us technologically and software-wise and is stable, ongoing partner. (…) CSHARK understands our challenges and industry therefore can provide reliable software solutions in highy competitive timeframe. – Niall Twomey, CTO, Fenergo

A proven track record in the industry speaks volumes about your partner’s capabilities. Look for a partner that has a successful history of delivering FinTech projects on time and within budget.

Assess their portfolio of completed projects, and pay close attention to the complexity and scale of the projects they have undertaken. This will give you insights into their expertise in handling projects of varying sizes and complexities.

Furthermore, consider the types of FinTech projects the company has worked on.

The landscape is vast and diverse, ranging from payment processing and digital wallets to wealth management and risk assessment. Make sure the software company has experience in developing applications or solutions that are relevant to your specific domain.

For instance, if you’re building a payment processing platform, a company with expertise in building similar payment systems will likely be a better fit than a company with a portfolio focused on other areas of FinTech.

Consider the technologies and frameworks the software development company has expertise in.

Choose a company that has a strong grasp of modern technologies such as blockchain, artificial intelligence, cloud computing, and data analytics. Assess their proficiency in using these technologies in their past projects to ensure that they can leverage the latest advancements to build innovative FinTech solutions for your enterprise.

Don’t Be Afraid to Ask

Finally, don’t hesitate to ask for references from the company’s past clients.

When in doubt, reach out to these references and inquire about their experience working with the company. Ask about their level of satisfaction with the quality of work, project management, communication, and overall experience.

Read more: How our FinTech Client Achieved a 30% ROI in Tech?

Understanding the FinTech Software Company’s Methodology and Processes

A company’s methodology and processes are like the backbone of its software development approach. They encompass how the organization plans, executes, and delivers projects. And they set the tone for the entire development lifecycle. A well-defined and efficient methodology can make a significant difference in the quality, timeliness, and success of your project.

When evaluating the methodology and processes, look for indicators of agility, transparency, and adaptability.

Consider whether they follow industry-recognized standards, such as Agile or DevOps methodologies, which are known for their iterative and collaborative approach.

Remember – a software development company that has a well-defined and mature methodology in place demonstrates its commitment to professionalism and excellence.

Communication and Collaboration are Key

We’re sure that we don’t have to convince you that the software development company you choose must have a transparent communication approach.

They should be responsive, accessible, and proactive in providing regular updates, addressing queries, and discussing project progress. Clear and open communication helps in avoiding miscommunications, minimizes risks of delays, and ensures that everyone is on the same page.

Seamless collaboration is also crucial in a FinTech software development partnership. The development company should be able to work closely with your team, understand your requirements, and actively engage in discussions.

A collaborative approach fosters creativity, innovation, and efficient decision-making, which can lead to better outcomes and successful project delivery.

Moreover, your FinTech software services partner should have a well-defined project management process in place, with clear milestones, deadlines, and deliverables. A robust project management approach ensures that the development process is organized, deadlines are met, and risks are mitigated effectively.

What’s very important in this matter is the ability to adapt to the current processes in your organization. At the end of the day, it doesn’t matter whether Agile/Scrum or other management methodologies will be used, as long as the project smoothly moves forward. It’s necessary that your tech partner remains flexible and doesn’t impose their way of operation.

Are You Compatible?

A software development company that shares a similar approach to development practices, project management, and communication can ensure smooth collaboration and seamless integration into your existing workflows. It allows for efficient decision-making and minimizes the risk of misunderstandings or delays.

Compatibility also extends to the company’s technology stack, tools, and frameworks they utilize in their development processes. Assess whether their expertise aligns with the technologies and frameworks used in your FinTech project. This compatibility can result in faster development cycles, reduced rework, and better outcomes.

In addition, evaluating the company’s flexibility and adaptability to tailor their methodology and processes to suit your specific requirements is equally important. A software development company that is willing to customize its approach based on your needs showcases its commitment to understanding and accommodating your unique business needs.

Conclusion

In the fast-paced world of FinTech, it’s important to remember that true innovation requires more than just surface-level hype.

It calls for a careful assessment of a software development company’s core competencies, expertise, methodology, and track record.

Don’t let empty promises sway you, but rather take a discerning and strategic approach to ensure a successful partnership.

Don’t shy away from asking the tough questions and looking into their project’s portfolio. Search for evidence of their technical capabilities, experience in the industry, and ability to communicate, collaborate, and manage projects effectively.

Remember, it’s not just about what they say they can do, but what they have actually done.

By conducting a thorough evaluation, you can ensure that the FinTech software development company you choose is the right fit for your requirements and goals. Demand substance and expertise.

Your FinTech innovation journey deserves nothing less.

If you have any questions or want to consult your project – contact us.