November 9th, 2022 | by CSHARK

How to Value Startup Equity? Practical Guide for Founders and Investors

Table of contents

Calculating the equity value of a startup can obviously be useful for its stakeholders, CEOs, and other business executives, but can also give some information to the company’s potential employees.

Many job offers include the perk of acquiring shares in the company, but not all of them give you straightforward numbers, so you need to evaluate it on your own.

This article aims to be a comprehensive guide to the startup equity value to help you decide which offer is worth your attention.

What is equity value?

Before we get into the technicalities and grab our calculators, let’s explain what equity value is.

Simply put, it’s the market value or market capitalization of a business. We can define it as the total value of the company that is attributable to investors.

Equity value is calculated by multiplying a company’s share price by its number of shares outstanding. It takes into consideration only the available equity. Hence, we have to subtract any debt or its equivalents, non-controlling interests, and stock, as well as, add any cash or its equivalents.

Before you start calculating the equity it’d be best if you also knew the basics like vesting (the process of earning an asset), cliff vesting (when an employee is fully vested rather than partially vested), and strike price (the fixed cost you pay for a share).

What’s the difference between market equity value and book equity value?

A company’s equity value is not the same as its book value.

The equity is calculated by multiplying the company’s share price by the number of shares outstanding while the book value is the difference between the company’s liabilities and assets.

For healthy companies, the equity value should exceed the book value and it’s always greater than or equal to zero. On the other hand, book value can be positive, negative, or equal to zero.

How to evaluate startup equity – questions to ask

Before you sign your contract, there are a few questions you can ask related to the equity value.

What percentage of the company’s equity will you be getting?

The number of options (a contract giving you the right to buy or sell an asset) the company is offering doesn’t give you too much information since the amounts of shares differ from company to company. That being said, the best way to look at it is through the percentage of ownership.

The crucial thing here is to ensure the company includes all shares outstanding, not just the remaining in the option pool.

Ask how many fully diluted shares outstanding there are, and then divide the shares in option grant by the total shares outstanding.

What percentage of the company’s equity will you be getting?

What is the process behind deciding how many options each employee gets?

Your employer should have a method for figuring out how many options to offer. If they also reevaluate that process regularly, it’s even better.

In a perfect world, the company should have corresponding equity and salary assigned to each role.

Does the company offer employee liquidity and refresh grants?

This is the critical question if you wish to sell the shares before an exit.

Suppose the company aims to stay private and ask if they plan to hold tender offers (an opportunity to sell the shares of equity by the stakeholders). You can also ask if the equity offers grants after some time or in some situations.

What was the company’s valuation after the last round of funding?

The company’s post-money valuation will give you an overview of how investors valued their shares. By multiplying that by the percentage you are offered you’ll get an idea of how valuable your grant is.

Pro tip: if the company doesn’t want to share, search the internet.

When do your shares vest?

You may have to earn your shares, or the right to purchase them, over time (so-called vesting). Make sure you know how long that is, and if the company offers RSUs.

Often, the vesting schedule is over four years with a one-year cliff. This means that after one year at the company you’ll have vested 25% of the initial grant. After that period, your options will vest monthly until fully vested after four years.

How long after leaving the company can you exercise the shares?

Maybe you won’t be staying the full four years (mentioned above) at the company, and that’s alright. As long as you’re over the initial vesting cliff, you should be able to keep everything you’ve vested.

However, if you’ve been offered options, after leaving, you may only have a certain amount of time to purchase them. That period is usually 90 days.

If the company goes public (or gets acquired), what’s the minimum valuation it needs for you to make a profit?

While investors get a guaranteed return, employees make a profit if the company is worth above a certain amount. It’s good to know what amount that is.

Once you get all the information, you can use one of the ready-made online calculators or spreadsheets created for equity calculations.

Factors that influence the equity value

Even though the calculations may be easy, there are still some interrelated factors present that can affect the value of your equity that you should be aware of. Those are:

Dilution

Dilution is all about how investments affect your share. If you join a startup at the pre-seed stage, how will your percentage look over time? The value of equity can increase after a successful exit, but before that, it will most likely decline.

Successful companies often need 4 of 5 rounds of financing on average before they can go public. Since to scale, the business will most likely need to raise outside capital, each time that happens the percentage of your equity gets diluted. Yes, you still own the same number of shares, but with their total number increasing, your equity percentage decreases.

Your ownership also gets diluted when your company issues options or RSUs to attract or retain employees.

Probability

What does the probability of success or failure mean in terms of equity value? Well, the majority of startups that raise seed money don’t make it to the next round.

On average, 70% of the companies in the seed round exit at zero. If the startup doesn’t reach the next financing round, your equity will equal zero.

Time to reach an exit event

The next thing to take into consideration is the time from receiving an equity grant to a future exit. The present value of money is greater than the value of money in the future. So even if the equity offer looks valuable, you won’t be able to realize its value until an exit event.

On average, it takes 7 to 8 years for startups to exit or reach a liquidity event (the point when you can cash out or access your equity value).

How much could my equity be worth and how to count your profit?

Generally, your equity will only be valuable if the company you decide to go for has a successful exit (through IPO or acquisition). That’s why you should carefully choose the company you want to work for, and not focus on the amount of equity proposed.

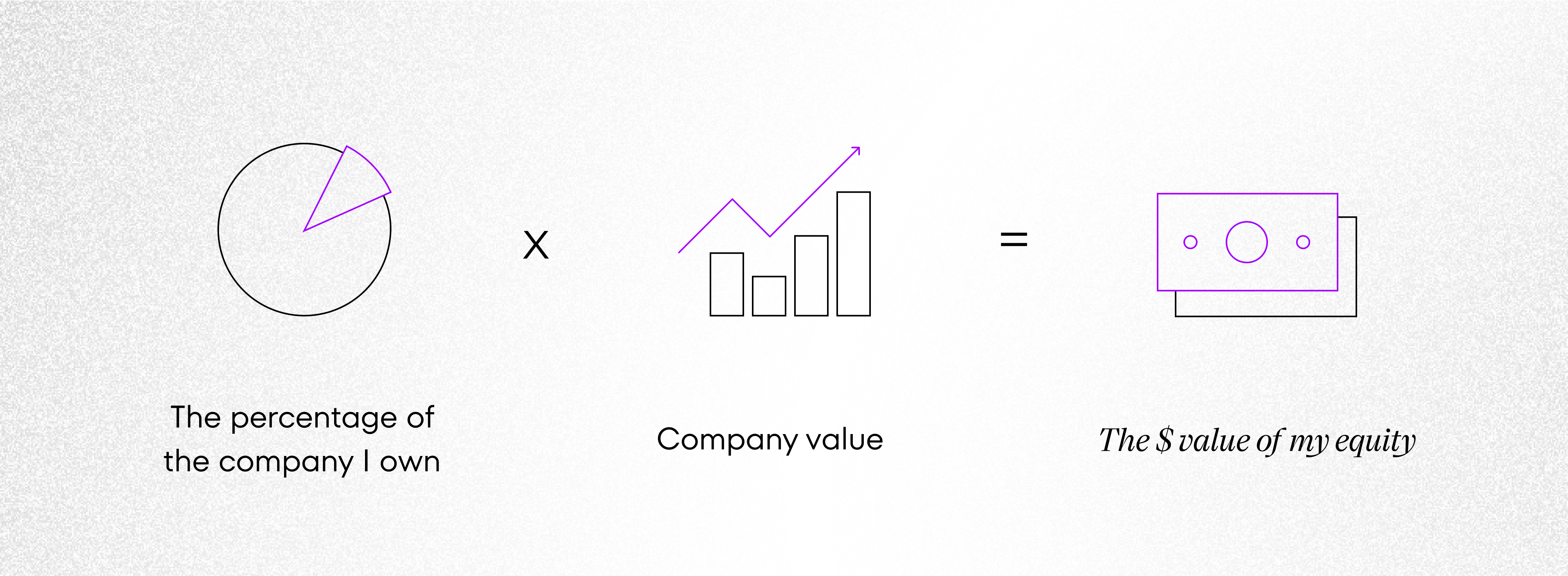

The quick calculation can look something like this:

How much could my equity be worth?

Keep in mind that when calculating the value of your shares you have to consider the company’s liquidation preferences and any additional taxes.

The percentage matters

The percentage of the options you own matters more than the actual number of them.

To calculate the percentage ownership simply take the number of shares you’ll get and divide it by the total number of fully diluted shares outstanding. You can get the number of fully diluted shares outstanding by asking someone from the finance or talent team at the company. That number should take into consideration all common stock, preferred stock, RSUs, options outstanding, unissued shares, as well as warrants.

Equity vs salary – what to prioritize?

Should you ask for a more base salary or more equity? That’s a valid question. There are a few things to remember when trying to answer that question. Those are:

Are you comfortable with risk?

Bigger equity can mean a bigger payout, but as with all investments it involves risks. You have to be prepared that your shares may not be worth anything. Is that a risk you’re willing to take?

What’s your financial situation?

If you decide to go the equity route, you should be able to cover all ongoing expenses with your current salary if, as mentioned above, your shares aren’t worth too much money.

How mature is the company?

Early-stage businesses are usually open to trading salaries for equity as they want to save money. The more mature companies won’t be so open to changing the equity allocation, especially those aiming for IPO (Initial Public Offering).

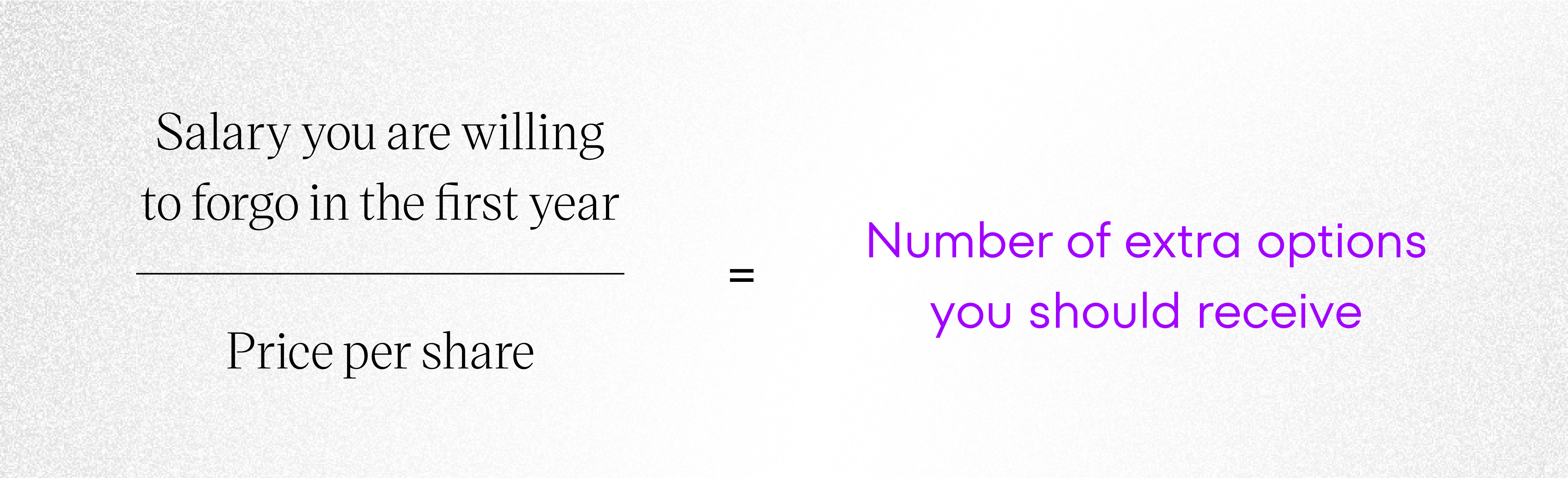

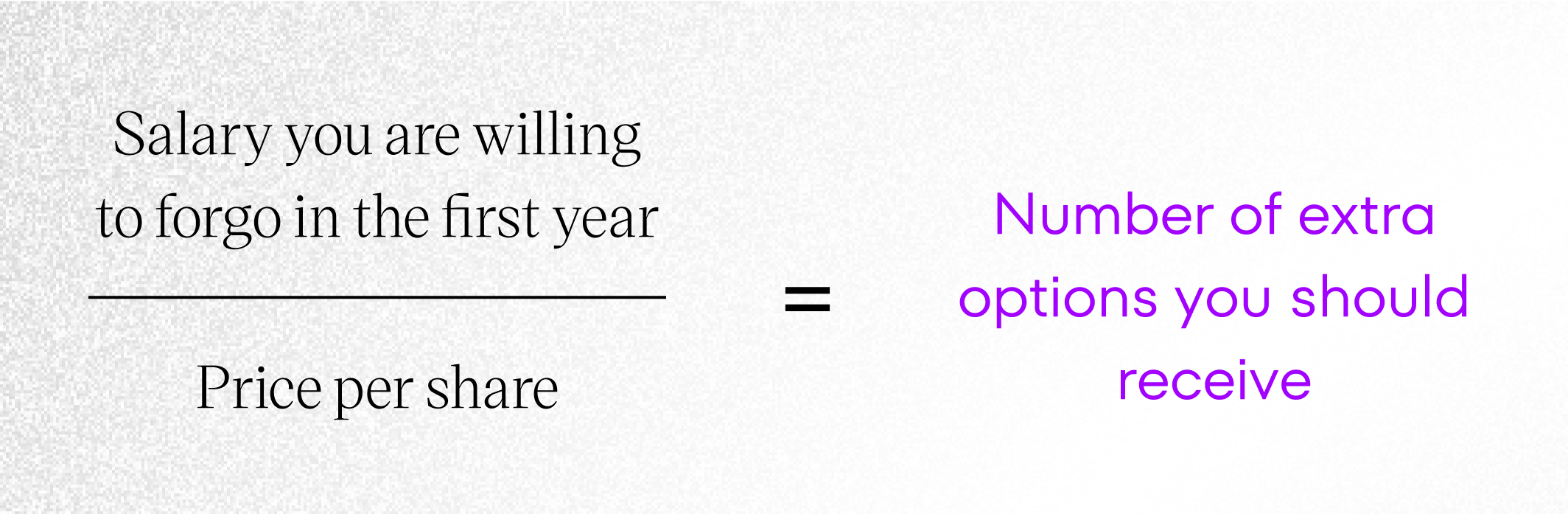

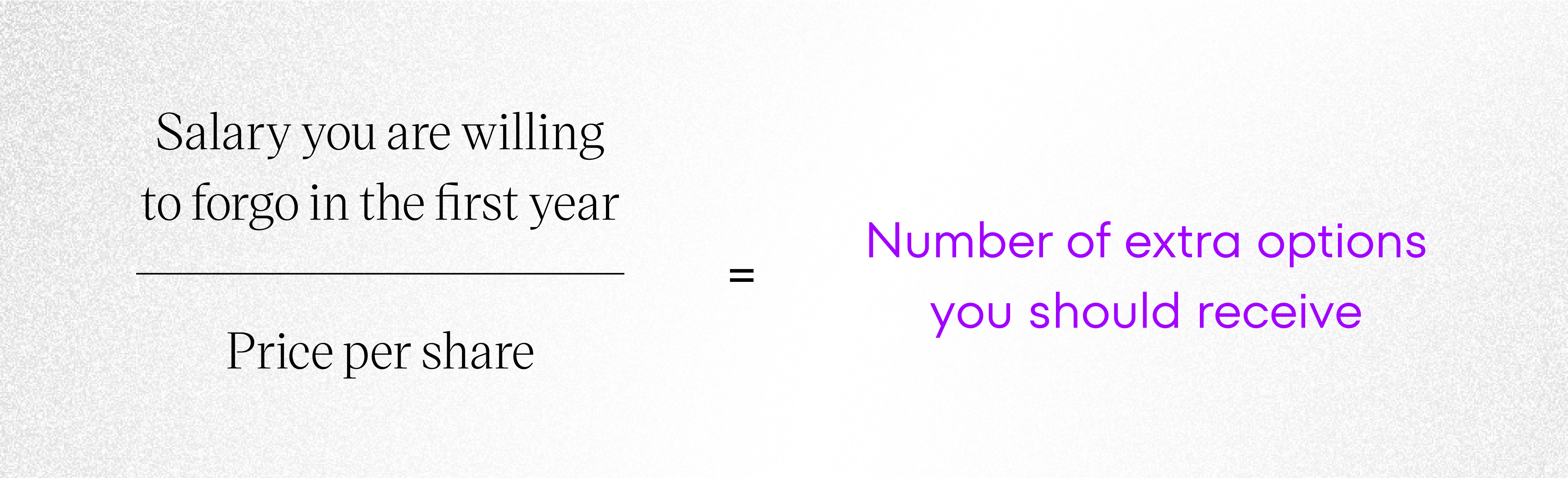

How much more equity should you get?

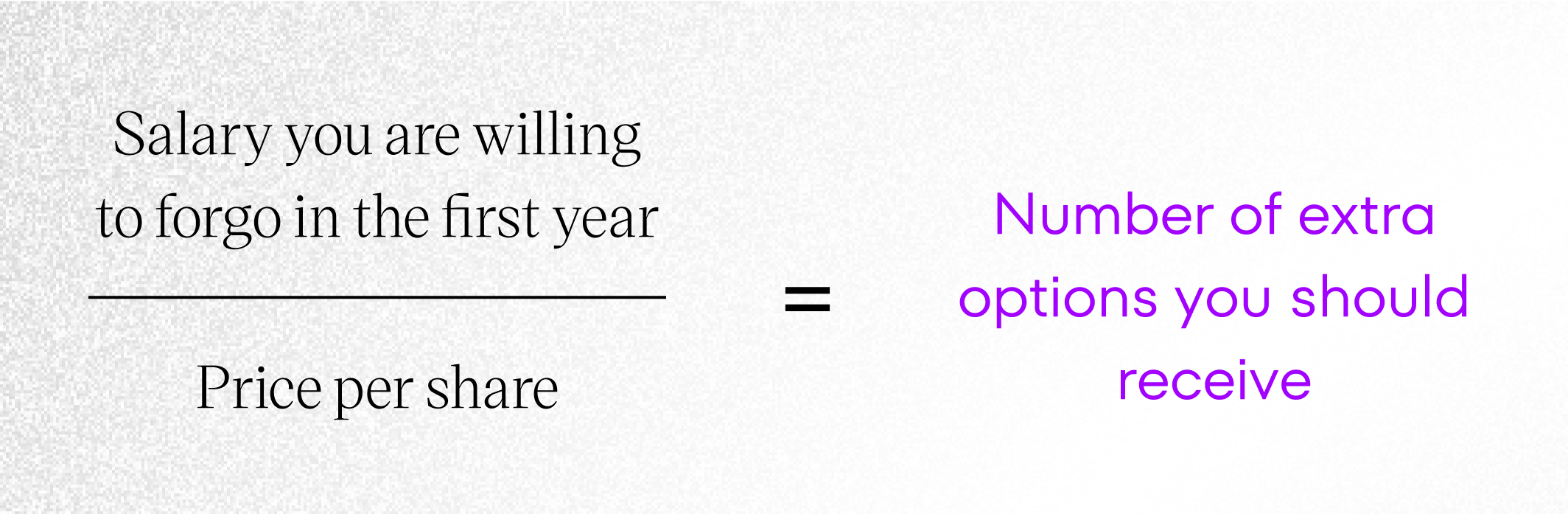

If you decide to trade an increase in salary for equity, you can use a simple formula to calculate how many extra options you should receive:

What percentage of the company’s equity will you be getting?

How to negotiate equity in a startup?

Even if the offer satisfies you, you can always ask for more – either salary or options. We’re aware that those conversations aren’t always a breeze, so we’re giving you a few tips on how to go about it.

- Be prepared – negotiations are always easier when you can prove you actually deserve more. Research what other people are making, present your relevant skills, measurable achievements, etc.

- Be sure what you care about the most – some people may ask for a higher salary, others for more equity. Decide what you want and focus on it. The above paragraph may give you a few deciding factors.

- Never give a number first – you don’t have to give them an exact number. If you don’t already know it, ask them for their range for the position and decide then.

- Find out what parts of the equity are negotiable – you’ll most likely be able to negotiate the number of shares.

- Check what other aspect of the offer you can negotiate – if the company isn’t willing to give you more equity, see if they can offer you a higher salary or additional bonuses.

Wrapping up

To wrap up, we’d like to offer you the last few words of advice when choosing the company you wish to work for (obviously staying on the topic of equity value).

Keep your excitement contained as it’s super common for potential employees to overestimate the company’s performance, and what follows, its value. You also shouldn’t look only for the companies with the highest valuation as they are similar to the hot stocks on the market.

Rather look for a startup with a reasonable valuation in an industry that interests you, with a good market fit and growth potential.