Developing a Cutting-Edge Debt Recovery Solution for a Tightly Regulated Market

Overview

Client Overview

Past Due Credit Solutions (PDCS) is a UK-based debt recovery company, that provides comprehensive solutions to industry leaders and enables the repayment of loans or debts to end users, i.e. clients of financial institutions. PDCS’s operation is regulated by the Financial Conduct Authority (FCA) and has to meet a number of legal requirements. Its reputation is built on chasing debts effectively and within regulatory guidelines.

Technologies:

Client’s Business Need

In the financial services sector, staying ahead means constantly innovating and creating digital

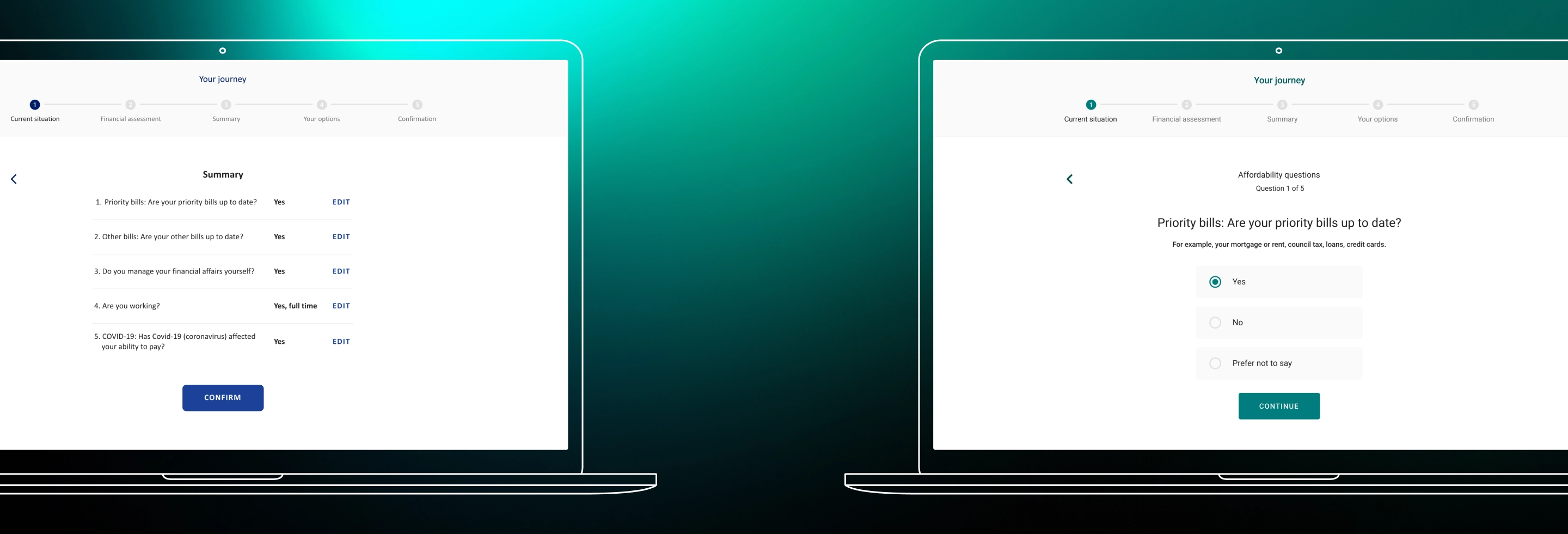

To this end, our goal was to create a state-of-the-art Digital Affordability Assessment Solution (DAAS) that would help institutions from diverse sectors (governmental, telecommunications, energy, banks, and financial service providers) recover their debts. PDSC’s clients could include such a tool on their website. Their debtors would use it to schedule repayment.

Challenge #1

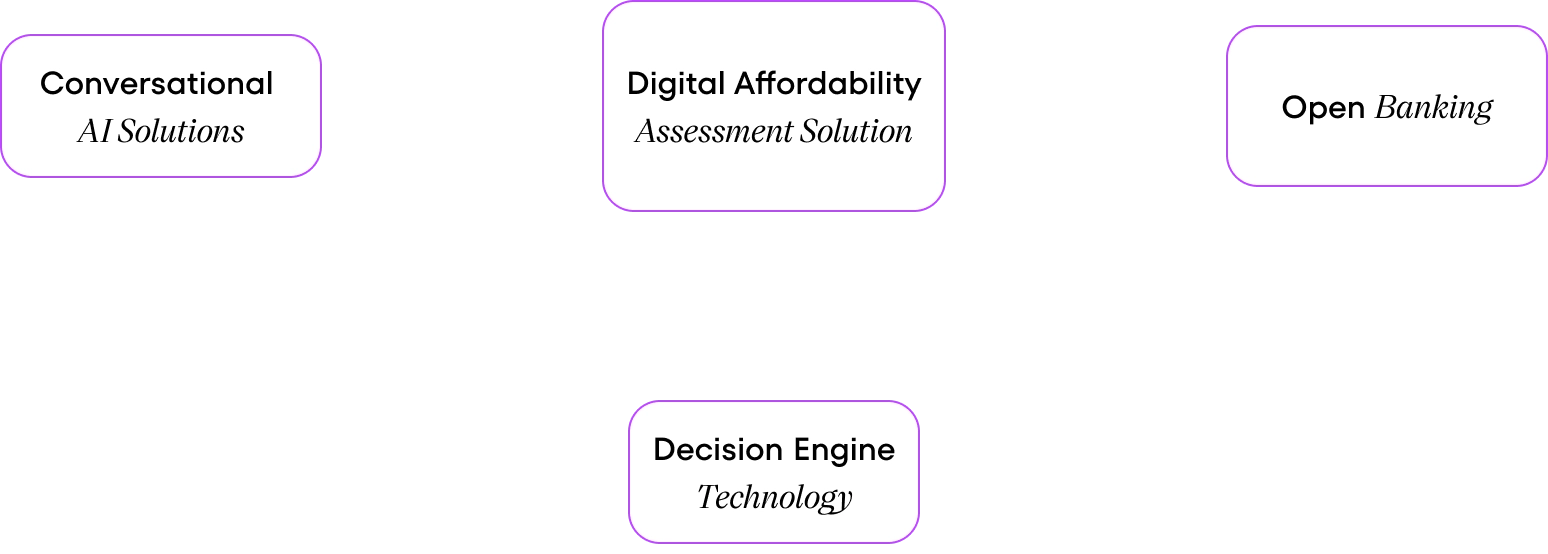

While on the surface the tool may appear to be a simple form to place on a customer’s website, in practice it consists of advanced decision engine technology, open banking systems, and conversational AI solutions.

All of them must be seamlessly integrated with the highest security standards.

Challenge #2

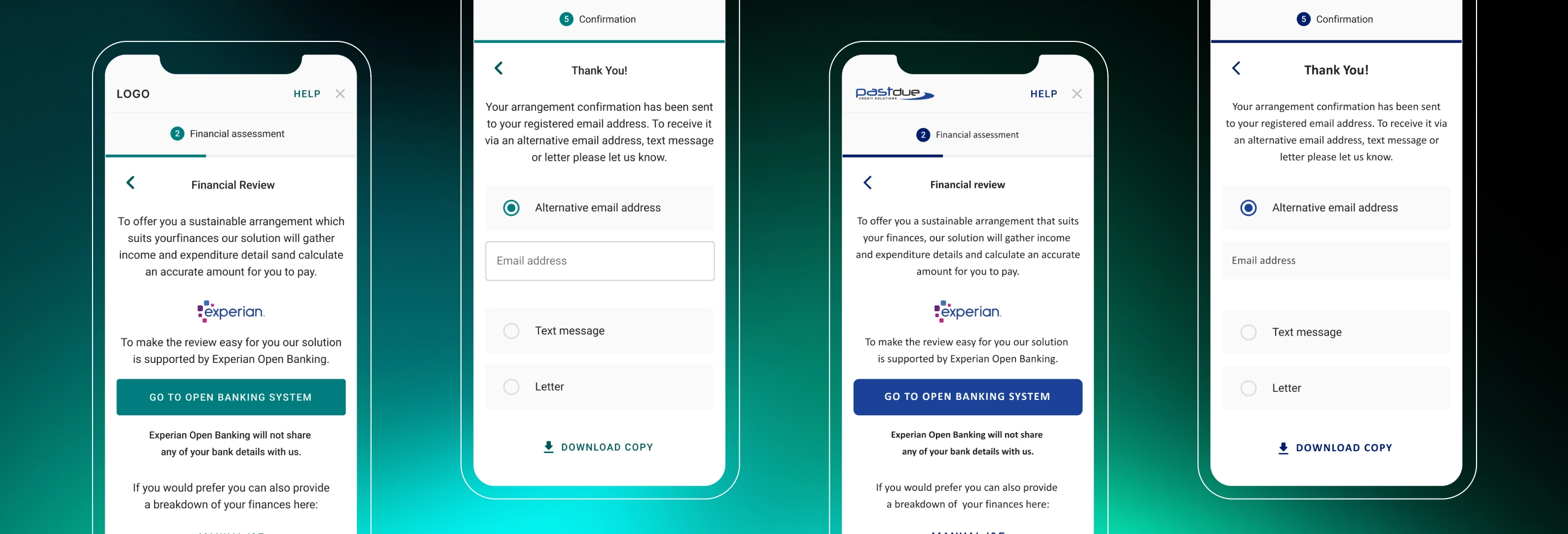

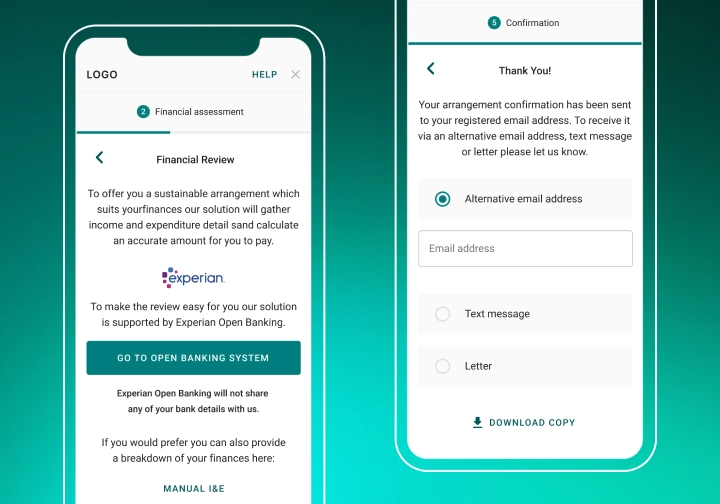

The PDCS business model assumed the creation of industry leading white label solutions.

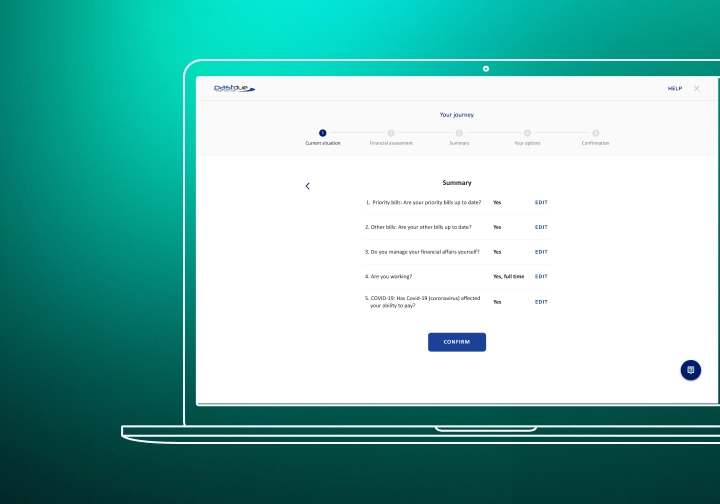

Essentially, it means that the end product would appear on customer websites as if the reselling company (PDCS’s client) created it from scratch, in their branding, while in reality, they have utilized an existing solution. So, we were responsible for allowing PDCS to sell the solution in this model.

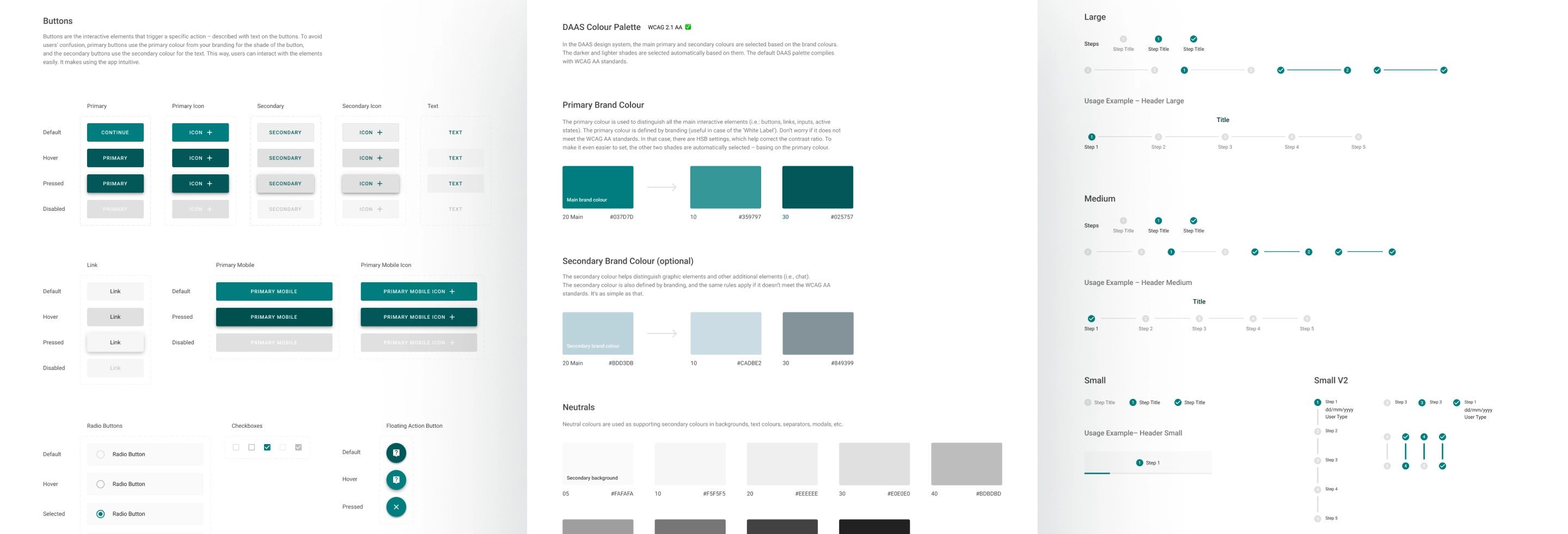

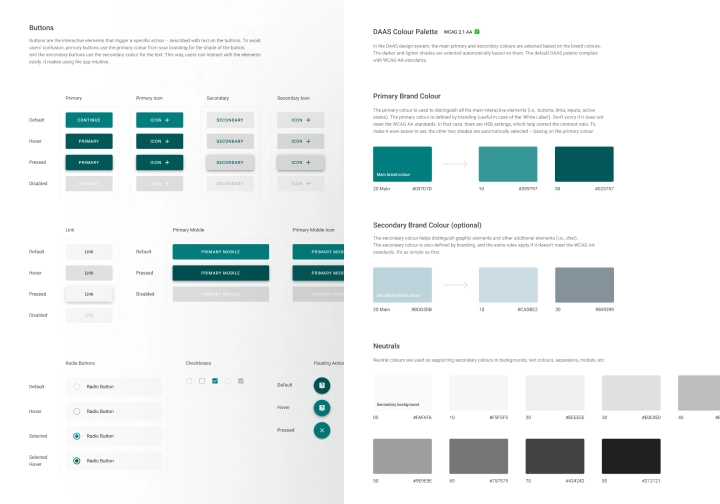

This, in turn, required an easy-to-use wizard and guidelines that would help customers adapt the DAAS tool to their brandings. The easy-to-use creator included the ability to use any color scheme, shapes, icons, and space for the client’s logo.

Challenge #3

Since the client’s business is strictly regulated, our next challenge was to provide privacy and data security.

In order to release the product, we had to meet numerous requirements, which an external company later audited. The prerequisite for releasing the application was a positive result.

Discovery Stage

As a consultant and technology partner, CSHARK was fully accountable for the entire product’s success.

As a first step, we researched the needs and requirements of PDCS, which were at the centre of our interest throughout the project. Our journey began with an intensive discovery phase where we delved into the intricacies of debt recovery and compliance regulations. These resulted in:

- an interactive prototype, which we extensively tested with real users to refine and validate the product concept

- the project scope

- technology stack and requirements.

The Process

During the project, we used Scrum in its purest form. By taking an agile approach, we prioritized adaptability and addressed evolving business and functional needs efficiently.

With years of experience, we helped advise the client on the best solutions that formed the application’s core, and then integrated them with the utmost care. We focused not only on the here and now, that is, seamless implementation, but also enabled future enhancements. To facilitate working with different brandings and colors in an accessible manner, our experts created algorithmic rules.

Best-in-Class White Label Solution

In the context of design, white label meant that our solution was flexible and customizable to align seamlessly with the visual identity of PDCS clients.

By creating a user-friendly creator, we provided the possibility to personalize color schemes, shapes, icons, and space for the client’s logo. White labeling in design allowed PDCS clients to focus on their unique branding, while the DAAS tool served as a robust foundation, enabling quick and efficient adaptation of the product to individual needs. Thanks to this process, the final effect on the client’s website appeared as if it had been created from scratch, fully accommodating their specific design requirements.

It is worth mentioning that at each stage of product development, our product design, front-end,

and business analyst experts worked closely together as one team. This close-knit cooperation translated into reduced implementation time, optimization of the product processes, and finally

into the success of the entire project.

Achieving Regulatory Compliance

We addressed all issues listed in the OWASP Top 10, a standard awareness document for developers and web application security.

The next stage entailed the proposal of solutions to ensure Content Accessibility Guideline Web (WCAG 3.0 at level AA) compliance, which were implemented. With these technical conditions met, the system was ready for a technical audit by an external organization.

We were impressed with CSHARK’s capabilities from the get-go. They were clear about what was expected and responded well to our questions.

Their ability to deliver resources quickly was great. Also, the technologies they used were outstanding, which supported the delivery of their services. Their software team was very skilled and delivered high-quality code.

Joshua Anthony

Director of Business Development, Past Due Credit Solutions

Outcome

Since its launch in August 2022, the DAAS has successfully aligned with PDCS’s timeline targets.

We delivered an intuitive and user-friendly solution that allowed the client to automate processes, save man-hours, and be fully usable by end customers (debt collectors). For institutions using PDCS services, DAAS is fully and easily customizable for any branding.

Additionally, thanks to the observance of the highest security and encryption standards, as verified

by an external auditor, the product was successfully introduced into this tightly regulated market.

Innovate

With Reliable

Business

Partner

Reach to us, and let’s initiate a strategic collaboration aimed at your success.